Introduction

Insurance expects a fundamental part in giving Insurance financial security and genuine tranquility for individuals, families, and associations. With different sorts of Insurance accessible, each customized to various parts of life, understanding your choices can assist you with coming to informed conclusions about overseeing risk. This article investigates the significant sorts of insurance, including wellbeing, life, auto, home, and business protection, to give you a balanced comprehension of how these contracts work. Ultimate guide Types of insurance.

What is Insurance?

Insurance is a policy between an individual or association (the safeguarded) and an insurance agency (the guarantor) wherein the back up plan consents to give monetary pay to indicated misfortunes or harms. The guaranteed pays customary expenses, and consequently, the insurance agency gives a security net to occasions like mishaps, disease, catastrophic events, or death toll. This arrangement of chance administration assists people and organizations with exploring monetary vulnerability, safeguarding resources and limiting likely misfortunes. Ultimate guide Types of insurance.

Why is Insurance Important?

Insurance offers basic help during startling occasions, permitting people and associations to monetarily recuperate. For example, without health care coverage, doctor’s visit expenses from a significant disease or mishap could monetarily destroy. In like manner, collision Insurance can take care of fix expenses or obligation in the event of mishaps, and extra security gives families monetary strength after the demise of a provider.

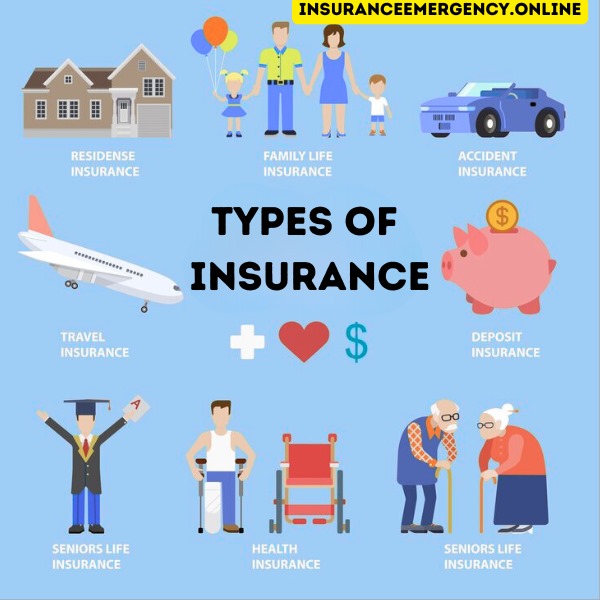

Major Types of Insurance

1. Health Insurance

Health insurance coverage takes care of the expense of clinical consideration, including specialist visits, medical procedures, solutions, and at times preventive consideration. Arrangements can fluctuate broadly, covering various sorts of medicines and meds. Health insurance coverage is frequently given by businesses, bought exclusively, or given by the public authority (like Federal medical insurance and Medicaid in the U.S.).

- Individual versus Bunch Health insurance coverage: Individual arrangements are bought by the insurance , while bunch protection is commonly presented through businesses and frequently covers representatives and their wards.

- Confidential versus General Health insurance coverage: Confidential health care coverage incorporates arrangements bought from insurance agency, while general health care coverage is government-given and frequently designated at low-pay or older people.

2. Life Insurance

Life insurance gives a passing advantage to the recipients of the protected in the event of their demise. This advantage can assist with taking care of burial service costs, remarkable obligations, or act as monetary help for enduring relatives.

- Term Life insurance : This strategy gives inclusion to a predetermined term, like 10, 20, or 30 years. It offers a demise benefit if the protected bites the dust during the term, yet it doesn’t collect money esteem.

- Entire Life insurance : Entire life strategies cover the safeguarded for as long as they can remember, offering a passing advantage alongside a money esteem part that develops after some time.

- All inclusive Disaster insurance : This adaptable strategy joins life inclusion with a venture part. Charges and advantages can be changed, and the strategy’s money worth can procure revenue.

3. Auto Insurance

Auto insurance is legally necessary in many places and gives monetary security against mishaps, burglary, and different harms including vehicles. It incorporates a few sorts of inclusion that change by strategy and area:

- Risk Inclusion: Covers harms to others or property in mishaps where the safeguarded is to blame.

- Crash Inclusion: Pays for fixes or substitution of the safeguarded vehicle in case of a mishap, paying little mind to blame.

- Thorough Inclusion: Covers non-crash related harms, like burglary, defacing, or catastrophic events.

- Uninsured/Underinsured Driver Consideration: Gives security in case the shielded is locked in with a setback with a lacking or no driver insurance.

-

Homeowners Insurance

Property holders Homeowners Insurance most critical resource: their home. This insurance commonly covers harms to the property, individual possessions, and obligation for wounds that happen on the property.

- Abiding Inclusion: Pays for fixes to the home construction because of occasions like fire, tempests, or defacement.

- Individual Property Consideration: Covers individual things inside the home, like furnishings, devices, and apparel, against damage or burglary.

- Commitment Consideration: Gives money related affirmation accepting someone is hurt on the property and the home loan holder is seen as in danger.

- Extra Regular expenses (Ale): Deals with the cost of brief housing if the home becomes terrifying in light of a covered event.

5. Renters Insurance

Leaseholders protection offers monetary Renters insurance to occupants by covering individual possessions inside an investment property. While the landowner’s insurance covers the design, leaseholders protection safeguards the inhabitant’s assets and gives risk inclusion.

- Individual Property Inclusion: Like mortgage holders insurance , this covers the occupant’s effects against burglary or harm.

- Responsibility Inclusion: Gives inclusion on the off chance that the inhabitant is viewed as at risk for wounds to other people or property harm.

- Extra Everyday costs: Covers brief lodging costs on the off chance that the rental becomes appalling.

6. Disability Insurance

Inability protection turns out revenue Disability Insurance assuming that the safeguarded can’t work because of disease or injury. This insurance assists people with keeping up with monetary solidness while they are for a brief time or forever unfit to work.

- Momentary Inability Protection: Turns out revenue for a restricted period, ordinarily as long as a half year.

- Long haul Inability Insurance: Offers inclusion for additional lengthy periods, at times until retirement age, contingent upon the contract.

7. Business Insurance

Business insurance safeguards associations from various money related risks, helping with guarding their undertakings, laborers, and assets. Kinds of business protection include:

- General Responsibility Protection: Covers risk for wounds or harms to others that happen on business premises.

- Property insurance : Covers harms to business property, including structures, hardware, and stock.

- Laborers’ Pay insurance : Expected in numerous areas, it gives advantages to workers harmed at work.

- Proficient Responsibility insurance (Blunders and Exclusions): Safeguards organizations and experts from cases of carelessness or lacking execution.

8. Travel Insurance

Travel insurance offers consideration for unexpected events that could occur during development, including trip scratch-offs, wellbeing related emergencies, and lost gear.

- Trip Crossing out/Interference: Repays prepaid costs on the off chance that the excursion is dropped or intruded on because of unanticipated occasions.

- Clinical service: Covers clinical costs and at times departure costs in the event that the voyager turns out to be sick or harmed abroad.

- Stuff and Belongings: Safeguards against misfortune or robbery of individual things during movement.

9. Pet Insurance

Pet insurance gives inclusion to veterinary costs, assisting pet Insurance with dealing with the expenses related with creature care.

- Mishap Just Approaches: Covers wounds or mishaps that require veterinary consideration.

- Extensive Approaches: Incorporate inclusion for the two mishaps and sicknesses, frequently covering medical procedures, prescriptions, and preventive consideration.

- Wellbeing Plans: Discretionary additional items that cover standard check-ups, inoculations, and dental cleanings.

10. Umbrella Insurance

Umbrella insurance offers extra obligation inclusion past the constraints of existing contracts like property holders, tenants, and accident coverage. This additional layer of security is helpful in claims or claims that surpass the responsibility furthest reaches of standard strategies.

11. Long-Term Care Insurance

Long Term Care insurance gives money related help to long stretch clinical thought, oftentimes covering organizations that typical medical care doesn’t cover, as in-home thought or nursing home expenses. This insurance is especially significant for developing individuals or those with steady conditions requiring widened care.

Choosing the Right Insurance Coverage

Picking the right insurance depends upon various factors, including individual necessities, money related targets, and lifestyle. The following are a couple of clues to consider:

- Survey Your Dangers: Think about your way of life, wellbeing status, monetary wards, and property possession. Various circumstances request various degrees of inclusion.

- Analyze Arrangements and Suppliers: Rates, inclusion choices, and client support can fluctuate fundamentally between suppliers, so contrasting various safety net providers and policies is savvy.

- Talk with an Insurance Specialist: Protection specialists can offer significant bits of knowledge and assist with fitting contracts to your requirements. They can explain complex terms and assist with tracking down reasonable strategies.

Conclusion

Insurance is a key piece of financial arrangement, shielding individuals and associations from unexpected events. By sorting out the different kinds of Insurance prosperity, life, auto, property holders, inhabitants, insufficiency, business, travel, pet, umbrella, and long stretch consideration you can seek after informed choices that help money related adequacy and internal sensation of agreement. Each kind of insurance assumes a remarkable part, covering different parts of life and work, eventually giving an establishment to a safer future.