The Role of Insurance in Financial Planning A Complete Guide

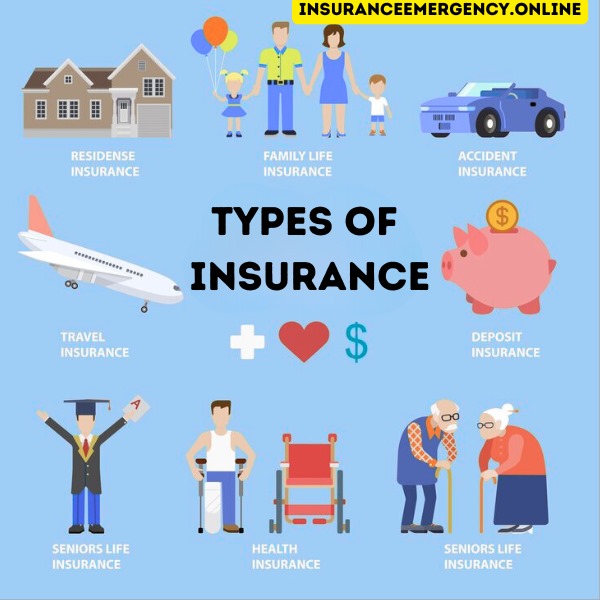

Introduction In the present questionable world, one Insurance and Financial Planning of the most fundamental pieces of monetary arranging is defending your assets, prosperity, adzing, insurance is often dismissed. Notwithstanding, protection assumes a vital part in moderating dangers and giving monetary security to people and families. This far reaching guide will investigate the significance of protection in monetary preparation, its different kinds, and how it squeezes into your generally speaking monetary system. Whether you are making arrangements for the future or managing unexpected conditions, understanding what protection works and how it means for your monetary strength is fundamental for long haul achievement. The Role of Insurance in Financial Planning A Complete Guide. What is Insurance? Insurance is a contract between an individual and a insurance office where the particular pays charges as a trade-off for money related protection from decided risks or disasters. Fundamentally, insurance is a bet the chiefs gadget that helps individuals with reducing the financial weight achieved by amazing events. The Role of Insurance in Financial Planning A Complete Guide. The essential capability of Insurance is to share risk. Rather than bearing the full monetary expense of a catastrophe or wellbeing crisis, protection permits people to spread the gamble across a bigger pool of individuals. Thusly, the weight on any single individual is limited, and backing is given in the midst of hardship. Why is Insurance Important in Financial Planning? Insurance Against Surprising Occasions Life is impulsive, and disasters or Financial Protection Plans emergencies can happen abruptly. Protection gives a prosperity net that shields you and your family from basic money related deficit in view of astonishing events like clinical issues, property mischief, or loss of pay. Model: If your home is hurt by fire or devastating occasions, your home Protection can deal with the upkeep costs, holding you back from standing up to a significant money related weight. Inward feeling of harmony Understanding that you have money related confirmation set up gives you veritable tranquility. Insurance licenses you to focus in on long stretch money related goals without obsessing about the fast impact of surprising events. Model: Having debacle Insurance ensures that your family is fiscally secure accepting you vanish of the blue. Pay Substitution For the people who depend upon their compensation to stay aware of their lifestyle, losing that pay can have serious financial results. Handicap Insurance and fundamental disorder security offer a security net if you can’t work due to illness or injury. Model: Failure Insurance helps cover a piece of your lost compensation if you can’t work considering a setback or disorder. Tax reductions Particular sorts of Insurance can likewise give tax cuts. For example, some calamity security procedures offer expense excluded payouts to beneficiaries, which can be a basic advantage in long stretch financial readiness. Types of Insurance for Financial Planning Insurance comes in many structures, and each type fills a particular need. Here are the most well-known kinds of protection that assume a vital part in monetary preparation: Health insurance Health Insurance is fundamental for safeguarding you from high clinical expenses. Wellbeing related emergencies can provoke tremendous expenses, and without medical care, you could go up against financial ruin. Medical services Insurance helps you with dealing with the cost of facility visits, solutions, operations, and that is only the start. Tip: Medical services Insurance is essential nowadays, where clinical prescriptions and clinical benefits organizations can be lavish without real consideration. Extra security Life Insurance gives monetary security to your family or recipients in case of your passing. It helps cover burial service costs, obligations, and can turn out revenue swap for your wards. Tip: In case you have wards, additional security is an undeniable necessity to ensure they are fiscally maintained whether or not you are at absolutely no point in the future close. Mortgage holders or Leaseholders Insurance Contract holders security covers damage to your property, robbery, and liabilities arising out of disasters that occur in your home. Tenants protection safeguards your own effects against robbery, fire, or other unexpected conditions. Tip: Whether you own or lease, having sufficient home or tenants protection can save you from monetary difficulty assuming everything goes south. Handicap Insurance Handicap Insurance replaces some portion of your compensation accepting you become debilitated or hurt and can’t work. Not the least bit like medical care, which takes care of clinical expenses, handicap insurance covers lost wages and helps you with staying aware of your lifestyle during an inconvenient period. Tip: Contemplate long stretch failure security if your occupation is really mentioning then again if you don’t have a support sort of income. Accident Insurance Mishap Insurance shields against financial hardship on the off chance that there ought to emerge an event of a setback or burglary including your vehicle. It moreover covers liability regarding damages to others’ property or wounds achieved by a setback for which you are skilled. Tip: Sufficient collision protection is significant on the off chance that you drive regularly, as mishaps can occur whenever. Long haul Care Insurance Long stretch consideration Insurance gives incorporation to organizations like nursing home thought or home thought, which are not regularly covered by medical care. As people age, the likelihood of requiring long stretch consideration increases, making this sort of insurance a huge piece of retirement orchestrating. Tip: If you mean to age at home or in an office, contemplate adding long stretch consideration security to your money related course of action. Umbrella Insurance Umbrella Insurance gives additional obligation inclusion past the restrictions of your home, auto, or tenants Insurance. This kind of strategy is particularly helpful in the event that you have significant resources for secure, like a huge home or ventures. Tip: Umbrella Insurance is great for people with critical resources who need extra security against claims or huge cases. How to Choose the Right Insurance for Your Financial Plan Picking the right protection relies on two or three elements, including your life stage, family circumstance, and cash related targets. Here are … Read more